The global oil market was hit again by the pandemic’s consequences. On Wednesday, prices dipped as Delta variant is spreading, the analysts said. Thus, the forecasts for fuel demand in China following mobility curbs from the spread of the novel strain of the COVID-19, offsetting a bullish outlook for US fuel demand.

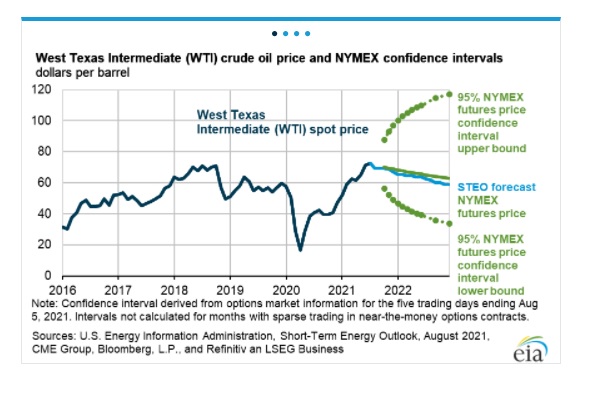

Both American oil giants, Brent and U.S. West Texas Intermediate (WTI), registered the dropping prices of $70.47 and $68.11 respectively a barrel Wednesday.

While both corporations have reclaimed their 100-day daily moving average, a technical chart indicator, they appeared to lack the momentum to stage meaningful revivals as Delta variant fears continued to weigh on markets.

Industry data showed US crude oil and gasoline inventories fell last week, while the US Energy Information Administration raised its forecast for fuel demand in 2021 and said consumption in May through July was higher than expected, supporting prices.

According to The Metro, the US Energy Information Administration (EIA) believes that the need for supply from OPEC will exceed its supply by 1 million barrels per day in the third quarter and by 300,000 bpd in the fourth quarter of 2021. In other words, with OECD commercial crude oil stockpiles having dropped back to pre-COVID levels already, a tightening oil market outlook will likely amplify oil price gains.

In its prognosis, EIA says “We expect Brent prices will remain near current levels for the remainder of 2021, averaging $72/b from August through November”.